Higher education is a costly investment, no matter how you look at it. A master’s degree costs thousands of dollars, perhaps even tens of thousands depending on where you attend and what degree you select. Let’s take a look at the different options you have when it comes to financial aid and educational loans.

What is federal financial aid?

The most familiar option for funding higher education is federal student aid. This includes grants, scholarships, loans, and other forms of financial aid. You probably filled out the FAFSA for your bachelor’s degree, and there is also aid available for graduate and doctoral work. If you take out federal student loans, you are required to pay the loan back with interest. The federal student loan interest rate is set by the United States Department of Education and is signed into law each year by Congress. The 2020 federal student loan interest rate for graduate students is 4.3%.

Shannon Lauffer, Dean of Student Services, The Art of Education University

Part of my role here at AOEU is to help our team guide students in understanding how a Master’s Degree can help shape their careers and lives. There is a lot to understand and consider as you look at funding options.

Let’s dig in.

Some schools don’t accept financial aid. Why not?

Federal financial aid is tied to Title IV of the Higher Education Act. While reasoning varies, many small universities do not participate in Title IV because it significantly increases operating costs. In fact, research on for-profit institutions shows the average tuition at Title IV participating institutions is more than twice that of non-participating schools.

Dr. William Bennett, former United States Secretary of Education, coined the Bennett Hypothesis, which determined a correlation between the expansion of federal financial aid and tuition increases. When more prospective students qualify for more federal aid, colleges respond by setting their tuition higher.

For small schools, not participating in federal financial aid means they can keep tuition lower. The Master of Arts in Art Education at AOEU costs $15,064, which includes all tuition and fees. Other Master of Arts in Art Education programs range from $19,000 to over $40,000, with the average cost around $26,000. That’s double the cost to attend AOEU. Even with low-interest federal loans, students will end up paying far more than students who attend AOEU and leverage other loan options.

But if an institution doesn’t accept federal financial aid, is it legitimate?

Participation in federal financial aid and accreditation are different—it’s kind of like the square and the rectangle. Institutions must be accredited by the USDOE to participate in Title IV and federal financial aid, but not all accredited institutions elect to participate. You should always research the accreditation of the school you plan to attend.

For example, The Art of Education University is accredited by the Distance Education Accrediting Commission and is recognized by the United States Department of Education. However, AOEU elects not to participate in federal financial aid to keep tuition low.

So, how can you pay for your degree if the institution you want to attend doesn’t participate in federal financial aid?

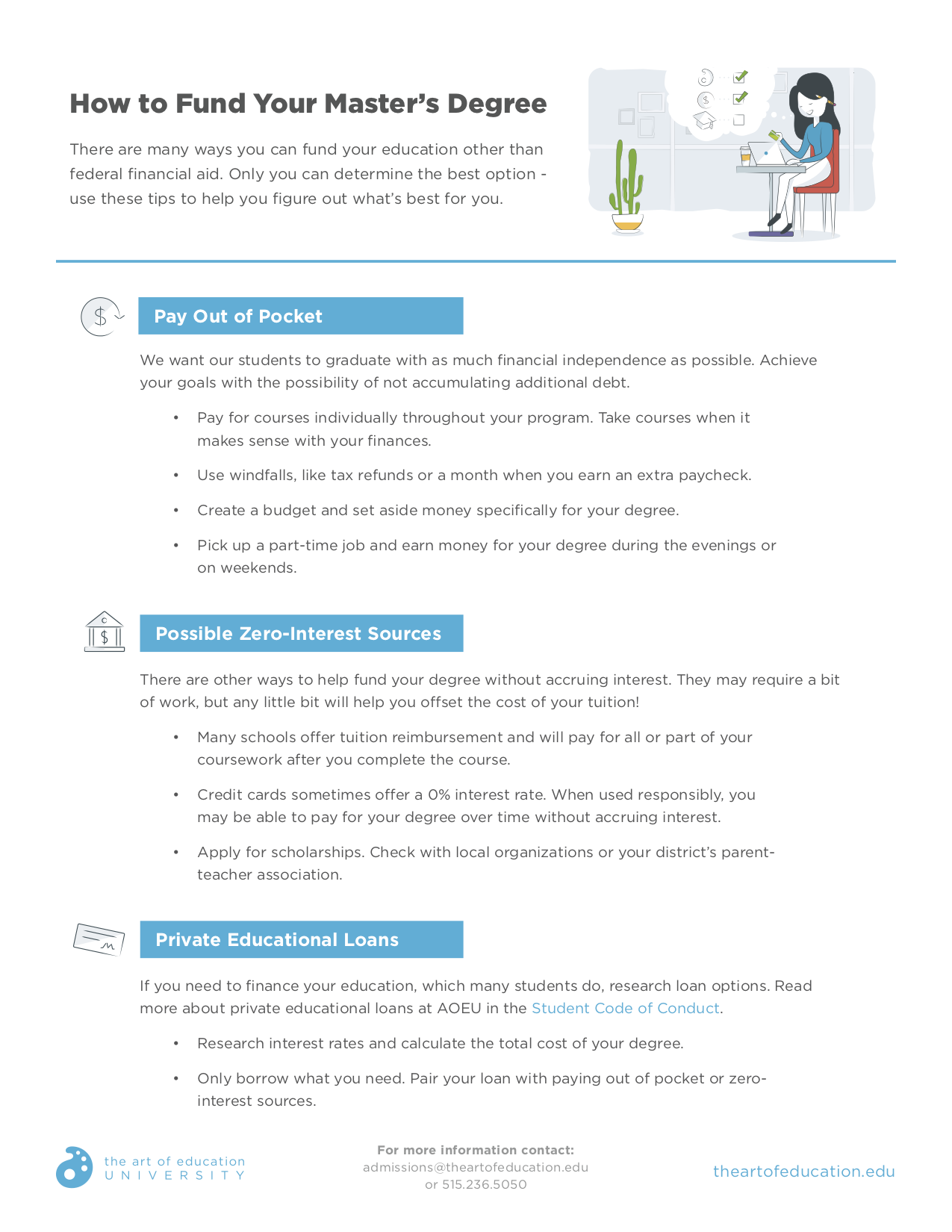

There are many ways you can fund your education other than federal financial aid. Only you can determine the best option. Use this download as a helpful guide.

Pay Out of Pocket

Students who pay for their education out of pocket graduate without student loan debt. This means there are no added strings attached to your degree. In other words, you don’t owe additional interest and will never have to pay more for the degree as time goes on. When you research graduate programs, ask the institution how you can pay for your degree as you go. Shorter terms generally have more start date options. Most courses at The Art of Education University, for example, are eight weeks long, and new courses begin every month. You can take a month off to save up for your next course, and you have up to five years to finish your degree!

Tips to pay out of pocket: Look for windfalls, like tax refunds or a month when you get an extra paycheck. Budget and set aside money specifically for your degree. Pick up a part-time job in the evenings or on weekends, if you’re able!

Possible Zero-Interest Sources

Look for other funding options. Many K-12 schools have tuition reimbursement programs, so part of your master’s degree may be covered. Look into scholarships available through your district’s parent-teacher association or other local organizations in your community. If either option is available, take the time to apply! Any opportunity that offsets part of your tuition is worth your energy. You may be able to pair tuition reimbursement or scholarships with paying as you go and lower the cost of your degree.

Tips for no-interest options: Many credit cards come with 0% interest rates. When used responsibly, credit cards can pay for courses before your school reimburses you. For an even better deal, get a credit card that has points or offers cash back!

Private Educational Loans

Private educational loans are usually based on your credit score. When it comes to loan options, do your research. These questions may help you determine the best option:

- What is the interest rate?

- Is the interest rate fixed or variable?

- How much will my degree cost when I calculate interest?

Tips for taking out private loans: Take a close look at your budget to see how much you really need to borrow. Pay for your courses out of pocket whenever you can and finance a course or two in between. Use a loan calculator, so you understand exactly how much you’ll be paying back for the amount you borrow.

Making the Best Choice

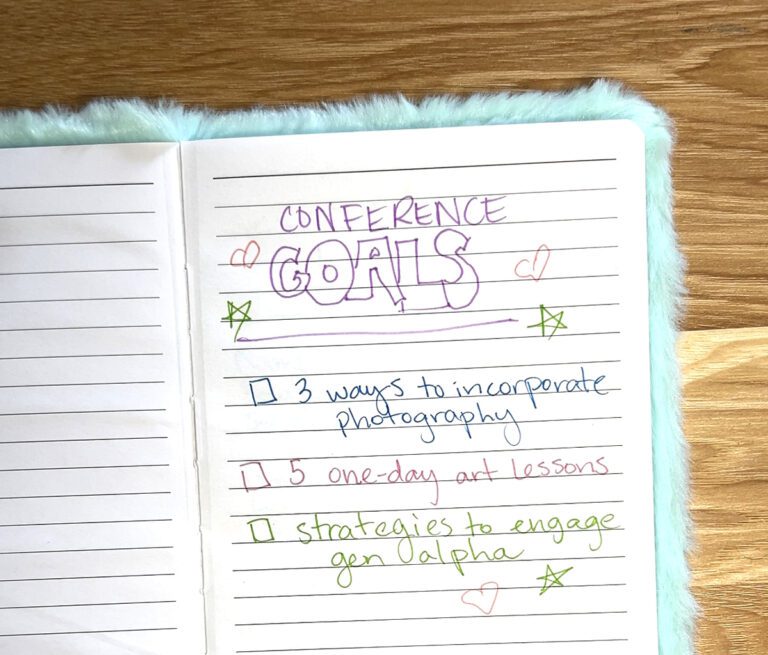

There are a lot of considerations when it comes to selecting a graduate program. Research multiple institutions and determine which best aligns with your professional goals and is the most cost-effective. Your education requires time, determination, and of course, funding. To help you determine the best opportunity for your graduate work, ask yourself these questions:

- What are my goals, and is this degree going to help me reach them?

- What is the total cost of attendance, including all tuition and fees?

- What financing options do I have? What can I budget for, what no-interest opportunities are available, and how much will I have to borrow?

- If you finance all or part of your degree: How much will I pay back with interest?

- What is the return on my investment?

If you’re interested in learning more about earning your Masters of Arts in Art Education at the Art of Education University, fill out this form or email admissions@theartofeducation.edu.

Earning your master’s degree is a true accomplishment. With hard work, a little research, and the right source of funding, getting your master’s degree is absolutely within your grasp!

What more information might you need about funding your master’s degree?

What other sources of support will you need as you pursue your degree?

Magazine articles and podcasts are opinions of professional education contributors and do not necessarily represent the position of the Art of Education University (AOEU) or its academic offerings. Contributors use terms in the way they are most often talked about in the scope of their educational experiences.